This Article examines the progress of renewable energy and energy decentralization in Sweden and Denmark. Both countries have numerous projects underway aimed at reducing dependence on fossil fuels and promoting greener energy options. These projects include boosting energy usage from renewable sources and adopting tools and technologies that will facilitate energy security and efficiency. Much of the work taking place in the two countries has the potential to be replicated in other jurisdictions.

Denmark is at the epitome of renewable energy and sustainable development. With twenty-seven percent of its total energy production sourced from wind turbines and twenty-four percent from natural gas, it is one of the leading countries in the world in renewable and sustainable energy production and consumption. Denmark is an excellent model for smart grid usage because it is the country’s primary source of transmitting electrical energy to end-users.

In Sweden, the energy and climate policies are based on both European Union (“EU”) legislation and national targets. In 2008, the Swedish government implemented a large-scale climate and energy policy.[4] The Swedish government decided that by 2020, fifty percent of the country´s energy production should come from renewable energy sources.[5] In fact, Sweden is ahead of its target and the country now expects to reach a production level of fifty-five percent from renewables by 2020.

Sweden’s overall goals are to have 100 percent renewable electricity production by 2040, net-zero greenhouse gas (“GHG”) emissions into the atmosphere by 2045, and increased energy efficiency of fifty percent by 2030.[6] Sweden´s ambitious energy and climate goals signal both a need for further improvement and the intention by the government to make those improvements.[7] Establishing a “smarter” energy system and enabling smart grid solutions to a greater extent will be important to achieving these goals.[8]

Section I of this Article focuses on Denmark, Section II considers Sweden, and finally there is a conclusion based on the two countries. This Article analyzes regulations in both countries that promote renewable energy, increase energy security, and achieve decentralization via technology such as smart meters and smart grids. This Article also identifies current barriers to achieving these goals. Further, this Article also addresses the countries progress towards electric vehicles and their storage systems. As data protection is a key concern with the advent of smart grids and smart meters, this Article analyzes regulatory considerations regarding data privacy and protection, both at the EU level and specifically within Denmark and Sweden. This Article provides recommendations for both countries, such as the need for further deregulation and greater financial commitments, among others.

Prior to the embargo of 1973, Danish energy supply was heavily dependent on imported oil.[9] The 1973 oil and gas crisis was a wake-up call for the country’s environmental and energy strategy. To ensure energy security, Denmark implemented immediate and long-term measures, including measures to achieve its ambitious development agenda and the diversification of its energy portfolio.[10] Government regulation was vital to this retreat from extreme oil and gas dependency. Denmark founded the Danish Energy Agency (“DEA”) in 1976 as a ministerial branch to oversee the electricity market.[11]

The DEA identified three main tasks required for the turnaround: (1) reduce vulnerability of the energy system via diversification and stock building in accordance with International Energy Agency and European Commission guidelines, (2) reduce the growth rate of energy consumption by enhancing efficiency in production and consumption, and (3) recognize energy related issues by promoting research and development.[12]

The implementation of a multi-tiered energy supply system prompted a shift towards domestic, rather than imported, energy sources. This pressured Denmark to expand its exploration in the Danish segment of the North Sea in search of locations to house natural gas and build a long-term energy stockpile.[13] Strategies for increased diversification were identified early, which made Denmark understand the importance of security of supply and other behavioral traits such as regulation on reduced imported fuels to increase national supply.[14] Diversification and a multi-tiered energy supply system would not only support the country’s energy security, but these programs would also help the Danish economy support its growing population.

The oil crisis changed the scene from a largely market-driven system to a policy-driven system. Planning and regulation were at the heart of Denmark’s strategy to secure electrical energy supply and reduce dependency on fossil fuels. Although planning was the main tool used to achieve the targets, introducing financial and tax incentives changed consumer behavior and demand.

A. Denmark’s Renewable Energy Sources

In the 1980s, efforts grew to explore renewable energy sources (“RES”) for generating electrical energy. Denmark set an RES target of four percent of the country’s total energy production. Wind turbines were already well established in Denmark and were popular amongst policymakers. Initially, commercial companies found it too expensive and cumbersome to build and maintain wind turbines. However, in 1990, the government introduced “Energy 2000,” designed to reduce energy consumption and CO2 emission.[15] In turn, the government program Energy 2000 would replace the national dependency on fossil-based fuels.[16]

Today, Denmark ensures continuity in its ambition to grow their Energy and Climate Outlooks. These targets are deeply embedded in Denmark’s political strategy to become more sustainable and to mitigate its GHG emissions. Denmark’s current energy agreement expires in 2020. Denmark needs a new strategy for the coming decade, 2020-2030, that will satisfy the country’s future energy needs.[17]

B. Denmark’s Electrical Energy

Denmark’s energy independence is unique in the EU. Denmark is almost entirely self-sustained in its energy usage.[18] Almost thirty percent of the country’s total energy production derives from renewable energy sources.[19] Wind turbines take great advantage of the windy climate and flat landscape, both on and offshore. For the past fifteen years, Denmark has had the highest wind energy production per capita, and its per capita production is almost twice that of the runner up for industrialized countries in the Organization for Economic Co-Operation and Development  (“OECD”).[20]

(“OECD”).[20]

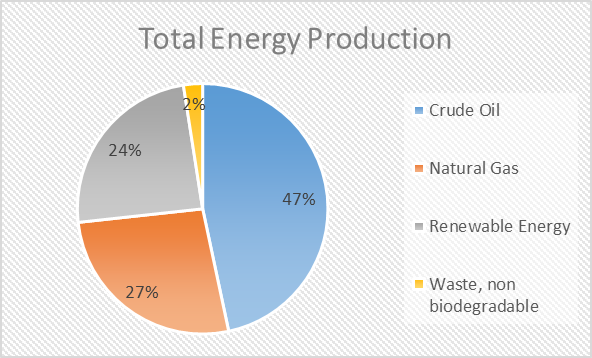

Figure 1: Energy production data, 2016[21]

Crude oil is the highest contributor to Denmark’s energy production.[22] However, Denmark is moving towards energy production from RES.[23] Renewable energy, as a share of total energy production in Denmark, has grown significantly since the turn of the century.[24] In 2000, renewable energy represented 6.9 percent of total energy production, whereas renewables in 2016 amounted to twenty-four percent of total energy production.[25] Denmark’s renewable energy production is now almost a quarter of its total energy production.[26]

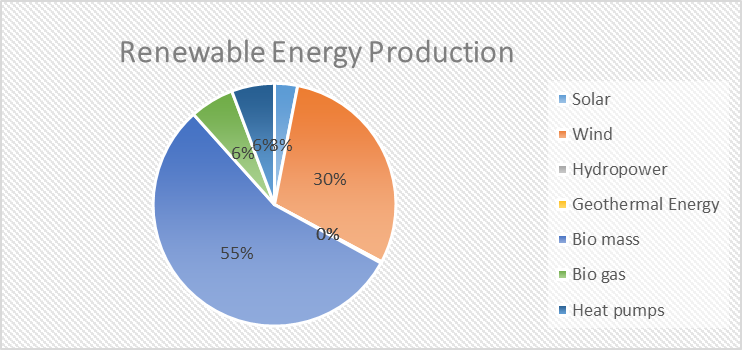

Since 1990, Denmark has seen a staggering 241% increase in renewable energy production.[27] The two most improved renewable energy sources are solar (4,659%) and wind power (1,994%).[28] At present day, wind power is the second highest contributor to Denmark’s renewable energy production.[29] In front, combined biomass production topples wind power at fifty-five percent of total renewable energy production.[30] Recent figures show renewable energy production is constantly on the rise as regulation and market demand support new solutions for green technology.[31]

Figure 2: Annual RES production of total energy produced data, 2016[32]

Wind power alone stood for 43.4 percent of electrical generation in 2017.[33] Electrical energy generation by wind turbines in Denmark is setting records worldwide whilst displaying a steady rise each year.[34] The numbers illustrate drastic change to the Danish and European energy systems, and provide insight into how renewable energy is changing the way the electrical energy system operates.[35]

It is crucial that policies and regulations continue forward progress. Grids need to account for new sources of electrical energy production, and governments need to deregulate to allow for new market players to enter the electrical grid. Digital systems are also fundamental to processing all the new data that accompanies new technologies. At the heart of data collection in the EU is consumer protection. To continue a larger scale objective to decarbonize our climate, interstate co-operation is required amongst the European countries to connect multiple grids to form a multilateral grid network.

Possibly more important than the increase in renewable energy and biomass production is Denmark’s reduction of fossil fuels.[36] Between 2012 and 2016, data from the DEA displayed a significant reduction of fossil fuels.[37] Denmark’s crude oil production decreased by thirty-one percent in this four year period.[38] Furthermore, out of the 82,707 gWh crude oil produced in 2016, over fifty percent was not retained for domestic consumption, but rather exported to other countries more dependent on burning fossil fuels.[39] The export of commodities such as oil is still a strong economic model, which in the short-term may assist funding medium- to long-term renewable energy source production and technological advancements, including electric grid technologies.

In 2016, Denmark’s total consumption of oil was 15.02 million tons. In descending order, electrical energy consumption by sector was: (1) transportation at thirty-four percent; (2) residential at thirty-one percent; (3) industry at twenty percent; and (4) trade and service at thirteen percent.[40]

The following Sections describe the significant challenges Denmark faces in improving its energy system. These challenges include: (1) large financial commitments; (2) the need to deregulate; (3) expanding RES; and (4) decentralizing energy policy.

4. Large Financial Commitments

Although large financial contributions are being deployed to develop the Danish grid, more funds are needed to secure the country’s ambitious growth. The 2016 Public Service Obligation (“PSO”) agreement provided significant funding for green transition costs, an encouraging change in allocation of the National Budget.[41] Funding for green energy systems remains an important topic in all fiscal prioritization discussions.

5. The Need for Deregulation to Foster Modernization and Funding of the Energy System

In the last few decades, strict regulations and planning have dominated energy policy.[42] In a market that is constantly changing on a global scale, micromanaging policies is not an effective solution. Denmark needs to deregulate the market to allow for organic growth and new players to enter the market.

Regulatory chains impinge upon the ability of RES to prosper in the market.[43] The regulatory chain allows for fewer cost-effective methods which ultimately increase consumer process.[44] For example, deregulated offshore wind turbines, subject to competition, have promised avid benefits in pricing and development. Additionally, only power plants are permitted to directly access the electricity market.[45] This regulation limits the potential for innovative business models that could provide more cost-effective solutions.[46] Such flexible and integrated systems will soon be necessary as renewable energy becomes more prominent.

The country’s tax structure is based on an era of fossil fuel reliance to produce electricity and, therefore, needs an overhaul. Prohibitive taxes on electrical heating and electricity creates obstacles to greener energy solutions as self-generating technology is too expensive to use.[47] In socioeconomic terms: green solutions such as heat pumps are not utilized due to less disposable income and high taxes and further development is not taking place.[48] In turn, the population is experiencing a deficit in economic gain and benefit. Therefore, there is a great need for flexible consumption to be explored in detail.

With an electricity system that has historically centered around power plants, regulation is not able to keep up with the increasing volumes of fluctuating green energy from smaller sources as well as international sources of energy. Larger power plants will diminish earnings under pricing pressure. On that basis, the system’s operating framework needs to adapt on a large scale, including connecting grids together.

6. Proliferation of RES is Pushing the Grid’s Capacity

One of Denmark’s top priorities is to expand the practical usage of green energy.[49] However, due to expensive technology, there is an increase in the cost of producing energy and selling it in the market. When technology is in its early stages, optimizing output is not the main priority, as this would limit the security of supply. Instead, early-stage technology should focus on defining its long-term benefit and how it can continuously grow to reach targets.

To innovate, Denmark will need to face its increasing volume of renewable energy with a more flexible and integrated system. Otherwise, it will be too costly to maintain the current security of supply in the energy, heating, and gas sector. Adapting to new technologies requires investing in storage and off-grid solutions. These technologies are crucial to balancing the system in times of over and under saturated production.

7. Decentralization of Energy Policy

Wind and solar energy are expected to double in northwestern Europe between 2020-2035 according to Denmark’s climate outlook.[50] The increasing volume of renewable energy will require even greater international cooperation. Therefore, the security of supply is transitioning from being a national issue to a supranational issue.[51] This might be classified as an opportunity where grid systems in multiple countries will be adjoined, creating interdependence between the adjoining grids. For instance, the price of wind power in Germany and the hydroelectric power produced in Norway is influencing electricity prices in Denmark more than electricity produced domestically. Thus price fluctuation may be seen within the national borders. During 2017, ninety-two percent of west Denmark had similar prices to one or more neighboring countries, whilst east Denmark shared the same prices with neighbors ninety-six percent of the year.[52] Policy drafters will need to keep this in mind when designing future incentives and trade agreements.

C. Denmark’s Governance System

For several years, Denmark has worked on its smart grid system, first identified in 2010 when a smart grid network was established along with major market players to make recommendations on how they thought the electricity sector and authorities could front smart grids. Through careful governance, the Energy Agreement of 2012 established political support to transition into a greener energy market, with an ambition to achieve fifty percent of electricity demand through wind power.[53]

To achieve ambitious climate targets, a close relationship between the central government and the energy sector is important. The energy sector plays the important role of developing technology that the consumer will adopt, making it attractive for households and businesses to make their consumption available for the smart grid system. Emerging trends are also key for policymakers to keep an eye on. For example, there have been many initiatives for developing wind turbine technology.[54]

Together with executive orders, the main legislation governing the Danish electricity grid and energy trade is the Danish Electricity Supply Act (“DESA”) of June 27, 2018.[55] The DESA ensures that the electricity market is regulated and provides for the security of energy alongside social, economic, environmental, and consumer protection. The DESA also sets an objective to secure consumer access to low-cost electricity.[56]

The Promotion of Renewable Energy Act of October 27, 2016 is perhaps equally important.[57] This Act promotes renewable energy production, mitigates dependency on fossil fuels, secures energy supply, and reduces carbon-based emission.[58] The legislation also incentivizes wind turbines and other renewable energy production facilities, promotes construction of wind turbines, increases access to offshore hydro and wind energy, and regulates renewable electric generation.[59]

The main market participants of the Danish electrical market have a clear structure of roles and responsibilities. The Danish Ministry of Climate, Energy and Utilities (“Ministry”) supervises and regulates the energy industry and oversees developing strategies.[60] The Ministry is the key government institution affecting national regulation and matters regarding energy and energy trade.

Beneath the Ministry is the DEA. The DESA authorizes the DEA to issue executive orders, propose regulations, and ensure compliance with the DESA for the relevant sections.[61] The DEA is also responsible for issuing licenses related to electricity production, transmission, and distribution.

The Danish Utility Regulator (“DUR”) oversees prices and market terms for and transmission companies connected to the grid.[62] The Danish Energy Board of Appeal, an independent body under the Ministry, formally questions decisions made by the DUR and the DEA.[63] In addition, the Energy Supplies Complaints Board handles legal complaints and disputes between private household consumers and the energy companies.

The Danish Transmission System Operator (“TSO”), Energinet.dk, is a state-owned independent public entity established by the DESA.[64] The TSO is responsible for securing the supply of electricity and gas and running efficient respective markets[65] The TSO is also responsible for ensuring the short- and long-term security of supply. [66] Further, as the owner and operator, Energinet.dk is responsible for DataHub.[67] DataHub, as a technical prerequisite to the supplier centric model and as a common data platform; facilitates and automates market interactions, including business transactions of the retail market; and receives meter readings from approximately 3.3 million metering points for both production and consumption. The centralized data system provides the market and all its participants with a level playing field. [68]

Denmark is part of the Nord Pool Group, a European electricity exchange. An entity that has entered into a Balance Responsible Party Agreement (“BRPA”),[69] the balance responsible party, oversees the buying and selling of electricity on the exchange. Daily, the responsible party must submit scheduling plans to the TSO for the expected energy consumption and production during the next 24 hours.[70]

In Denmark, the Distribution System Operator (“DSO”) owns and controls the network between the transmission grid and the consumer, and it has a monopoly on the transportation of electricity in its geographically demarcated grid.[71] Part of the DSO’s responsibility is to measure electricity consumption and generation within its regional grid and report the data to a metering point administrator.

3. National and Regional Transmission – Public Service Obligations and Smart Metering

Fifty-seven local electricity distribution companies own and operate the distribution grid. Local municipalities or organized end-users own and control the grid supply area.

The Danish TSO charges a Public Service Obligation (“PSO”) tariff to cover the costs related to the public service obligations of the TSO and the grid companies as provided in the DESA and the Danish Promotion of Renewable Energy Act. The tariff is a charge levied to support renewable energy and is paid by the suppliers to the TSO based on total electricity consumed in their area of delivery. In November 2016, an agreement regarding the PSO was reached by a majority in the Danish Parliament. Parliament agreed to gradually abolish the PSO tax but have expenses shifting between the consumer-paid PSO tariff and the Finance Act.[72] Now, the DEA calculates and sets quarterly and yearly PSO tariffs.[73]

Denmark defines incentives and subsidies for renewable and green technology for energy production. The Promotion of Renewable Energy Act’s wind turbine subsidies serve as one example of such subsidies. For example, onshore grid-connected wind power, connected since February 2008, benefits from a feed-in premium of 0.25 Danish krone (“DKK”) per kWh of electricity for the first 22,000 hours.[74] Offshore wind farms are subject to separate incentive schemes. A feed-in premium by the wind farm at Horns Rev 2 enjoys an added DKK 0.518 per kWh, and the wind farm at Rødsand 2 receives DKK 0.629 per kWh.[75] These premiums apply to electricity production of 10 Terawatt hours (“TWh”) for a maximum of twenty years.[76] Furthermore, smart meter rollouts are sourced to independent companies. Smart grids and meters are at the forefront of the Danish energy strategy–fully supporting grid technology and connectivity to the grid and constantly investing in new technologies. Several grid companies are in the process of installing smart meters in their supply area.[77] By 2020, intelligent remote-readable electricity meters should be installed in each of Denmark’s 3.3 million usage points. [78]

Denmark has an active energy partnership with Germany. This is a formal continuation of earlier relationships, where the aim for a two-year period between 2017 and 2019 was to enhance cooperation between the two authorities. This valuable partnership will be used to share and learn from each other’s experiences; ultimately transitioning towards a greener energy dependency.[79] Danish and German stakeholders have shared that the partnership aims to develop areas of Combined Heat and Power (“CHP”) production, including district heating and energy efficiency in buildings, industry, and energy production facilities.[80]

This intergovernmental partnership brings a rich history of strong energy regulation and technological advancement to the table. Denmark leverages decades of experience in transforming their own energy system. Additionally, Denmark has knowledge on information sharing of green efforts for clean, prudential, and stable energy systems from other past and ongoing collaborations with numerous countries.[81] This cooperation explores topics in the aforementioned areas by analyzing, inter alia, different policy measures, infrastructure, obligation schemes, taxes and legislation, storage solutions, and interactions between energy sources.[82] Danish government institutions assign specialists to aid international cooperation.[83]

This cooperation takes place by exchanging experts and specialists from the DEA and the Danish Embassy in Berlin, with the DEA closely managing and engaging in regulatory matters. There is also evidence of close connections between the Embassy, the DEA, and external organizations and businesses who can advise on matters related to technical developments, regulatory affairs, and energy framework in Germany. This form of knowledge exchange and partnership is imperative to facilitating a deregulated market where multiple participants create an interlinked interstate grid network throughout the EU and European Economic Area (“EEA”).

This Section introduces the Danish regulatory framework by discussing the oversight and governance of the electricity market. The first Subsection details regulated activities, non-regulated activities and the status of unbundling in the Danish market. The second Subsection analyzes relevant tariffs related to the production, use, and trade of electrical energy, and ultimately how it affects the end user. The third Subsection introduces some of the incentives available for renewable energy technologies. Lastly, the fourth Subsection analyzes the Danish energy security dimensions and how the Danish grid is evolving through interconnectivity.

The DESA is the main law governing electrical energy in Denmark.[84] The DESA’s purpose is to ensure the electrical energy distribution in Denmark is safe and in accordance with a socially conscious, climate friendly, and consumer protective approach.[85] The aim of the legislation is to ensure that consumers have access to low-cost electrical energy.[86] Accordingly, the legislation promotes sustainable energy by encouraging energy savings, use of CHP, and environmentally friendly sources of energy, while securing the efficient use of financial resources to support healthy competition in the electricity market.

In Denmark, smart grids are regulated under the Executive Order on Energy Saving Services in Grid and Distribution Entities. The Executive Order promotes grid and distribution entities’ cost effective and low energy consumption methods for energy consumers and society at large.[87] The main focus of this Executive Order is to ensure that distribution and grid entities ensure efforts of energy saving for the end-user.[88] Annex 1 and section 6 to the Executive Order display targets for the average energy saving distribution that grid companies must strive to achieve.[89]

The DEA requires a license to carry out activities related to energy exploration, production, transmission, distribution, and storage. Additionally, a permit is needed for establishing plants and for any expansion or changes to plants where pollution may increase.[90] The city or regional council issues permits depending on the size of the plant.[91] If a major plant is to be built, the Planning Act may require a public hearing and an environmental impact assessment.[92]

ii. Regulatory Status of Unbundling

Following the third Energy Package Directive,[93] European electricity grids are subject to unbundling obligations to ensure the separation of vertically integrated utilities. This results in separation of the various energy supply stages ranging from generation and production to distribution, transmission, and the supply of electrical energy to the end-users. In order to adhere to the unbundling principles, a DSO must hold the necessary human, technical, financial, and physical resources to operate independently. This must be obtained without the managerial or financial influence or assistance from vertically integrated undertakings.[94] A DSO must therefore be able to retain the necessary resources at its disposal to primarily operate, maintain, and develop its network without unduly relying on the services and other parts of vertically integrated undertakings.[95]

The main transmission grid in Denmark has secured unbundling.[96] Conversely, there are fifty DSOs in Denmark covering a total distribution grid of 159,000 kilometers (“km”) and delivering electrical power to approximately 3.3 million end-users.[97] The obligations in the Electricity Directive Article 26 on unbundling have achieved integration in the Danish ESA.[98] The legislation together with an Executive Order on internal monitoring program for network and transmission companies and Energinet sets out the legal framework that binds DSOs to ensure that they will not be influenced by commercial means or interests.[99]

Historically, Danish tariffs included a grid tariff, a system tariff, and a PSO tariff.[100] Tariffs for the use of the electricity grid are fixed by the grid owners and subject to DERA regulation.[101] Tariffs are regulated based on a revenue framework that sets out the maximum annual revenue for a distribution company.[102] In principle, the tariffs are fixed at 2004 levels and may only increase by a regulated inflation rate.[103] Capital costs for necessary new investment, or other expenses by the grid companies, may also result in increased tariffs subject to the approval of DERA.[104] Tariffs and actual revenues are reviewed annually by DERA, and any differences between the approved revenues and actual revenues are settled in the tariffs.[105]

Because Energinet.dk is a state-owned company, it is regulated not to build up any equity or pay dividends to the Danish Ministry of Energy, Utilities, and Climate—its owner.[106] This strict cost plus regime is closely monitored for the TSO to recover necessary costs and return on capital to ensure its efficient running.[107] In the event that the TSO encounters any surplus capital gains, it must transfer them back to the consumer via reduced tariffs.[108] This return to the consumer normally happens the following calendar year, though in some cases it may take longer for balancing purposes. Likewise, when the TSO suffers a loss, consumer prices increase.[109]

DERA also determines DSO’s capital returns ceiling.[110] The revenue cap allowed by Danish DSOs is a regulatory price per kWh multiplied by the anticipated kWh transported in the following year.[111] This ensures that fixed price tariffs are not unduly increased, and provides control over the market price.[112] The DESA mandates that the maximum returns on grid assets are fixed to the yield of a long-term mortgage bond rate plus one percent.[113]

The grid tariff covers the TSO’s costs relating to the operation and maintenance of the national and regional transmission grids (400/150/132kV). Whilst the system tariff covers costs relating to reserve (production) capacity and system operation.[114] The PSO tariff covers the TSO’s costs relating to public service obligations as provided for in ESA.[115] The supplier, and ultimately the end-users, pay the tariff based on the amount of electricity consumed in their area of delivery. Previously, Energinet.dk set the PSO tariff, but due to a change in system, the DEA is not responsible to determine the tariff quarterly.[116]

In 2017 a new subsidy scheme for electricity intensive businesses was established through after the EU approved the PSO tariff change proposal.[117] In total, the scheme established a pool of 185 million DKK[118] to cover the period of 2015-2020. Eligible companies can apply to cover part of their PSO related to their electricity usage.[119] Furthermore, at the beginning of 2018, the government abolished PSO tax, allowing more investment in coastal areas for offshore wind turbines and farms. The government has also invested one billion DKK in wind and solar technology for 2018 and 2019.[120]

The Danish electricity system is in a state of rapid transformation. There is evidence of proliferation of renewable energy and interconnections with other countries. Denmark is a major participant in the Northern European Nord Pool grid. New and different production and technology patterns are creating a new-era demand which will lead to a Danish electricity system that differs significantly from today’s system. By increasing the number of interconnections, Denmark will become a key part of a regional, rather than a national, electricity grid system. Comparable developments are also taking place in neighboring countries. The Nordic model is displaying an important value of emerging towards the same holistic goal. The European Council endorsed a plan to support an Energy Union to further promote regional connectivity and collaboration on security of supply.

E. Renewable Energies in the Grid

The objective of the Promotion of Renewable Energy Act is to promote renewable energy and the security of energy supply while reducing GHG emissions.[121] Together with the DESA, the Act successfully implements the EU Directive of Renewable Energy. The legislation established a “green scheme” for the Ministry to provide grants to companies to undertake renewable energy projects, explore offshore energy, and connect more wind turbines to the grid.[122]

Building on the green scheme, the legislation offers detailed feed in premiums[123] for the production of electrical energy by using renewable resources and enforcing reporting obligations on participating grid companies.[124] There is also an initiative to fund small-scale renewable energy plants that are connected to the grid. The fund allows for up to twenty-five million DKK per year for four years and will be managed by Energinet.dk. As determined by Energinet.dk, renewable energy grants respond to spot or sample prices on the electricity market.[125] At this point, renewable energy plants are still unable to compete financially with fossil-based energy production plants, so wind turbine owners may benefit from subsidies. The subsidy amount is based on when the wind turbines were connected to the grid and their size.[126]

F. Energy Trading and Cross-Border Relations

Interconnected trade increases the security of Denmark’s energy market and, by extension, the EU market. Denmark trades with nearly all its neighbors, mainly through participation in Nord Pool, which runs a central power market in northern Europe. To date 360 companies from twenty countries trade on Nord Pool, with 524 TWh of total volume traded.[127]

Independent traders do not need a license to enter the energy market, nor are they required to have a local presence or subsidiary in order to pursue local energy trade. However, the TSO must grant an approval to the trader before they are admitted.[128]

The absence of a license to trade physical power between wholesalers or end-users makes it possible to supply all Danish end-users with physical power without a license. However, commercial users and traders have strict reporting requirements.[129] The reporting must include conditions which help to ensure the best possible competition for electricity production and trade.[130] These requirements help protect the market and secure healthy competition.

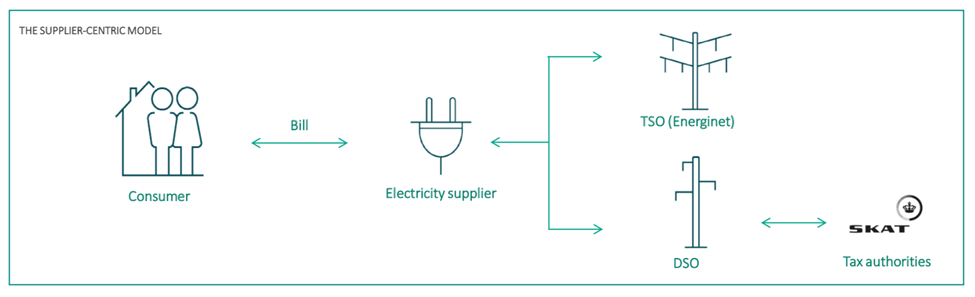

Denmark’s electrical energy system is based on a supplier-centric model.[131] This model was introduced in April 2016 with the objective of introducing a new market design, increasing competition, and allowing for new product and service developments that satisfy consumer needs and demands.[132] The function of the supplier-centric model permits 100 percent of consumer contracts to run via electricity suppliers.[133] This leads to the consumer receiving one bill with one point of contact to the electricity market. The electricity supplier bills the consumer directly for network usage, energy taxes, and levies, before settling its end with the TSO and DSO.[134]

Figure 3: The Danish Electrical Energy Market[135]

This model is reliant on the flow of data, facilitated by DataHub, and established in the DESA Section 5(2) as an IT platform that Energinet.dk owns and controls.[136]

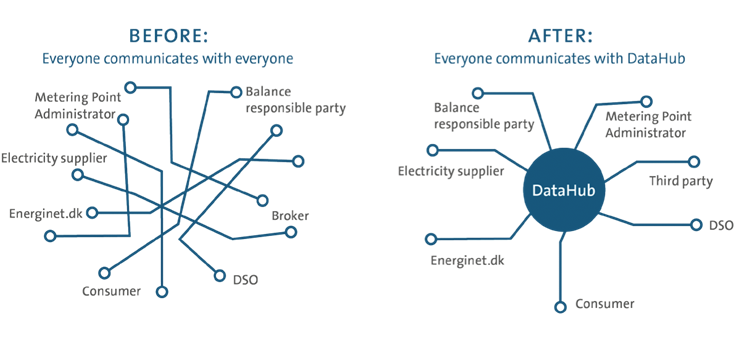

A level playing field is extremely important for market transparency, and it allows new players to enter the market at a lower entry cost. DataHub enables a standardized process for registration and distribution of market data, ultimately allowing businesses, suppliers, and consumers access to the same data simultaneously.[137] Denmark has gone to great lengths to understand consumer needs by granting them easy access to their metering data.[138] There is a major difference between before and after DataHub was initialized, as illustrated below.

Figure 4: The Danish Electrical Energy Market[139]

DataHub developed a four-layer approach to describe its functionality. First, the security layer provides a protected access portal that retains the user information in an encrypted and traceable environment.[140] Second, the presentation layer houses services related to market support and monitoring as well as operational administration for the general running of the electrical services.[141] Third, the business logical layer handles alterations in consumer information, such as address changes, provider changes and submissions of consumer master data.[142] A large portion of processing, calculation, and flow of data also occurs in the third layer. Finally, the data layer contributes aggregation and reconciliation.[143] This is also where DataHub processes time series, meter readings, and master data.[144]

The Decree on Smart Meters and the metering of electricity incorporates EU Directive 2012/27/EU to install a smart meter in every Danish household by December 31, 2020.[145] When the decree was implemented, 3.25 million households were identified as complying with the installation target.[146] In conjunction with its 2020 objective, Energinet.dk has been moving towards hourly reading of electricity.[147] The model is currently in effect with consumers whose consumption exceeds 100 MWh per year. Currently, large consumers consist of fifty percent of electricity consumed.[148] Almost two thirds of Danish consumers, or approximately two million people, have a smart meter installed.[149] To achieve this objective, all IT systems currently in place, including DataHub, must be able to read and receive hourly data from smart meters, for hourly settlement.

Technical specifications set out in the Decree on Smart Meters stipulate that smart meters must be able to register and deliver data on electrical energy in 15 minute intervals.[150] The registered data must also be stored by DataHub for the consumer to review their consumption and anticipated cost.[151] Grid companies use the transmitted data to estimate consumption and determine pricing.[152]

The definition of demand response may be explained as follows:

Changes in electric usage by demand-side resources from their normal consumption patterns in response to changes in price of electricity over time, or to incentive payments designed to induce lower electricity use at times of high wholesale market prices or when system reliability is jeopardized.[153]

The European Parliament’s committee on Industry, Research, and Energy (“ITRE”) stated during one of its workshops that to cope with an increasing amount of intermittent RES, the old paradigm of consumption-based (demand-based) supply will no longer be applicable. Instead, to ensure a more cost-efficient model, the electricity system needs to become more flexible to secure a constant balance between supply and demand. [154]

There are two basic goals of demand response: (1) to lower overall demand and (2) to flatten the daily demand curve. In a comparison of total consumption data between 2007 and 2017, there was little change in response, and where improvement was visible it was only negligible.[155] Demand response through smart meter installation has a 2020 target of reducing nationwide electrical energy demand in Denmark by two percent.[156] In Denmark, energy consumption has reduced by approximately ten percent per capita over the ten-year period 2007-2017.[157] During this period, residential electricity rates increased by approximately sixteen percent.[158]

When posed with issues of grid efficiency and expansion, the DESA requires consideration of control of demand and decentralized production before looking at the need to expand capacity.[159] With the proliferation of renewable energy technologies and the Danish government’s ambition of replacing fossil fuels with RES by 2050, the electricity grid will experience a vast increase in volume and with that, growing challenges.[160] Smart grid technologies will help support this development by, for example, enabling DSOs to automatically adjust the electricity consumption of end-users. This may be done by shifting consumption to off-load the grid, for instance by lowering temperature, light, or ventilation levels in houses or other structures.

The price increase and demand decrease must be counter measured against an increasing population. In the ten-year time span of 2007-2017, the population increased by approximately 300,000.[161] This will ultimately increase demand for electrical energy but may be offset by energy efficiency, indicating that the market will require better flexibility.[162] Several recommendations on demand flexibility for the Nordic market are being published via a report by THEMA Consulting Group.[163] Compared to the rest of Europe, Denmark and Germany already have the highest electricity rates. It is therefore not wise to increase the price of electricity without also allowing consumers better opportunities to resell excess production of their own energy from SV panels, hydropower, wind, heat pumps, or other green technologies back to the grid.

In terms of actual usability and impact on consumer prices, Radius, an energy supplier, published their new hourly tariffs after smart meter installations.[164] Smart meters and smart homes allow consumers better insight into when they use their heavy consumptive appliances, washing machines/tumble dryer, TV, oven, etc., and when they should use them for better cost-efficiency.[165] However, the majority of consumption is between 5 p.m. and 8 p.m., creating a significant increase in costs to the consumer over the year.[166] Danish consumers have voiced their concerns regarding this cost increase.[167]

The data generated from smart meters is, and will continue to be, available for consumers and market needs. Transparency echoes through the Danish model and highlights areas where the Danes may inspire other countries to emulate the same. Increasing transparency for the consumer via hourly rates and price signals from the wholesale market makes it easier to identify the actual cost of energy. Smart meters and their data incentivize Danish consumers to adjust consumption according to price. For instance, a Danish consumer might opt to charge their electrical vehicle at night when the price is low or switch off appliances that consume a lot of energy when they are not using them. Ideally, smarter technology should be able to detect price fluctuations via integrated artificial intelligence (“AI”) systems and regulate a household’s energy consumption without manual input. Overall, Denmark is on track to reach 100 percent smart meter rollout by 2020.

The Danish Data Protection Authority (“DPA”) is responsible for enforcement of the Danish Data Protection Act, and ensuring compliance of entities required to follow its provisions.[168] The DPA aims to supplement and implement the articles set out in the General Data Protection Regulation to protect a person’s rights and freedoms and mitigate the unlawful processing and collection of personal data.[169] Furthermore, the Danish Data Protection Act requires controllers and processors of personal data to draft internal regulations to ensure compliance and data security.[170]

1. Digitalization to Promote Smart Grids

The Danish Ministry of Energy, Utilities, and Climate believes in transparency and value creation through digitalization.[171] It uses data collection, processing, and distribution to promote growth of renewable energy technologies.[172] By supporting data sharing among major market contributors, such as authorities and companies, society may benefit from new value and important profits resulting in efficiency gains. These efficiency gains can be achieved via centralized data collection that is readily available to a number of administrative systems and sectors.[173] Currently, all data on energy is collected via DataHub.[174]

2. Data Protection and Smart Meters

Denmark’s data protection regulation is set out in the Danish Data Protection Act.[175] This comprehensive piece of legislation is of general application and therefore applies to smart grids.[176] The Act defines personal data broadly to include not just data related directly to natural persons, but also data by which a person may be indirectly identified by reference to other kinds of personally identifiable information.[177] The legislation has successfully incorporated the General Data Protection Regulation (“GDPR”) to cover the collection and processing of personal data carried out, in full or in part, that is contained or is intended to be contained in an electronic or physical filing system.[178] It sets out a firm framework to cover all the basic requirements for securely using, processing, and collecting personal data. Obligations for controllers of data include: (1) prior consent to personal data collection and processing; (2) registration of data controllers and processors; (3) obligations for data controllers to uphold data security; (4) obligations to promptly inform data subject, the data protection authority, of data breaches which compromise personal data; (5) data subject access request; (6) data subject data deletion request; and (7) portability rights.[179]

DSOs are required under the DESA to submit information regarding consumption to consumers.[180] Most Danish end-users already have a smart meter installed, and the DESA requires DSOs to publish hourly consumption data.[181] DataHub is the central source of information where end-users may log onto their account to view and download their energy consumption and billing information.[182] All consumer data is stored on DataHub’s central platform and submitted to energy suppliers via encrypted files. Suppliers may only view data for their own consumers, unless consumers have given their consent.[183] Smart metering data is the property of Energinet’s DataHub—a DSO—but the data collection aspect lies with energy distributors to submit data to suppliers, DataHub, and end-users for billing and payment purposes.[184]

Smart meters themselves have technical requirements to store encrypted data which must be readily available for the consumer.[185] This data is also sent to energy distributers, who are responsible for providing hourly meter readings to DataHub. Energy companies have a responsibility to protect consumer information, and they are subject to the Data Protection laws as a controller and processor of data.

Consumer safeguarding is of the highest priority to the European internal energy market. The Danish Data Protection Act requires controllers to ensure that any processor they instruct will guarantee adequate personal data security and compliance with the GDPR.[186] In this respect, controllers must have contracts with their processors that contain enhanced processor clauses.[187] These measures help protect personal data insofar as processors are responsible to report any breach of data.[188] Any data breach that meets the requirements must be reported to the data protection authority within seventy-two hours, and if found to have a high likelihood of impact on an individual’s rights and freedoms, then communication must also be sent to the data subject without undue delay from the time of awareness.[189]

Although smart meters have taken a great leap, their continuous development is crucial to better handle, store, and communicate data. Bearing in mind the drastic expansion of smart meter installations in Denmark, and Europe in general, they need to feature state-of-the-art secure storage and backup systems as well as convincing contingency plans.

A smart meter is essentially a big data collector which gives insights into the daily habits of a household, such as time spent at home, schedule for work and school, appliance usage, and other habits. Such information is extremely valuable for many parties and makes the consumer a key stakeholder for future insights and development of household energy technology and consumer needs.[190]

In order to successfully deploy and develop smart technology such as smart meters or smart homes, data management technologies must be in place to securely encrypt and handle increasing amounts of consumption data. Consumer privacy protection reflects the basic requirements to protect an individual’s rights and freedoms and must be one of the foundational building blocks to smart meter technologies. Once in place, smart meters may be used as an important tool to motivate consumers to be more energy efficient by being more aware of their consumption. Smart meters may also aid in creating a more resilient energy security system.

4. Concerns About Smart Meters

Concerns include the amount of data collected, the means of collection, and what happens with the data.[191] Large conglomerates and small start-ups are all fighting to get their hands on consumer data in order to get a better picture of consumer demand, and this puts a high price on an individual’s data. Consumer data has become one of the most valuable commodities. Some Danish consumers are alarmed by the forced installation of smart meters in their homes and have raised arguments that the State is concealing the true purpose of smart meters.[192]

Though there are data protection mechanisms in place, consumers have the right to choose which data is collected and what is done with that data.[193] However, there is no “real” consumer choice in whether to have a smart meter installed in their household.[194] Many Danes consider this an invasion of privacy, which goes against an individual’s rights to protection of personal data under the EU Charter of Fundamental Rights.[195] The thought that government agencies and energy companies are monitoring and controlling patterns of household consumption makes many Danes anxious.[196]

J. Electric Vehicles and Storage

Denmark has an ambitious target of selling its last petrol-fueled vehicle in 2030 and becoming independent of fossil fuels by the year 2050.[197] Currently, personal vehicles account for approximately half of emissions within the transportation sector.[198] Electric vehicles (“EV”) are likely to play a prominent part in helping Denmark reach this target.[199] EVs have a high level of energy efficiency and are able to utilize electricity generated from renewable energy sources. Due to the lack of a domestic automotive industry, external producers will highly influence the availability and affordability of transportation technology. However, this does not mean that Denmark will lack influence in the sphere of developing policies to promote such technologies.

In Denmark, there are approximately 20,000 electric vehicles.[200] Denmark’s 2030 goal is to stop the sale of new internal combustion vehicles and sell 100 percent emission friendly cars–whether electric or plug in hybrids.[201] Until 2016, registration fees for electric vehicles were waived, which attracted many buyers.[202] However, this was halted when the government decided that this was an infringement on the free market and gradually reintroduced registration fees of EVs until reaching a parity with conventional vehicles in 2022.[203]

The removal of the EV incentive scheme had a major impact on the sale of EVs in Denmark.[204] Up until the exit of 2018, there was a lack of incentives for consumers to choose an EV or hybrid vehicle over an internal combustion vehicle in Denmark. Despite other barriers, such as lack of charging stations, lack of free urban parking, high costs of EVs and short range, Demark sold 2986 EVs between January 1, 2019 and October 1, 2019. This was a 321 percent increase from the same period in the preceding year.[205] Importantly, Danish tax authorities decided in 2018 to require annul registration fees for EVs with a value up to 59,000 United States Dollars (“USD”). EVs with a value exceeding this will pay a registration fee of twenty percent.[206]

Compared to its Nordic neighbors, the 2018 sales number is extremely low. Norway has a total of 251,307 EVs and 110,274 PIHV.[207] This high number is likely due to government incentives designed to meet its 2025 target. By 2025, the Norwegian Government aspires to only sell zero-emission vehicles. [208] The Danish government has promised half a million EV or plug-in hybrid electric vehicles (“PHEV”) on the Danish roads by 2030.[209] To reach this goal by 2030, the Danish government is rethinking its strategies to incentivize consumers to switch from internal combustion-based vehicles to zero-emission vehicles.[210]

i. Regulatory Improvements and Incentives

The relevant legislation that has adopted the clean vehicles directive is the Decree on Climate Conscious Purchases of Vehicles for Road Transportation.[211] The Decree’s purpose is to promote cleaner, more energy efficient vehicles.[212] The Decree requires contractors and official bodies to consider the vehicle’s energy and environmental impacts of its lifecycle, including impacts around energy consumption, CO2 emissions, emissions of NOx NMHC, and other particles.[213]

Though the Decree promotes the purchase and regulation of climate conscious vehicles, there are no direct incentives incorporated in the Decree for purchasing a climate friendly vehicle. The legislator had an ample chance to establish regulatory incentives for EV and PHEV buyers but missed an opportunity to do so.[214]

The Danish Council on Climate Change (“Council”) is an independent expert organization that annually reviews climate issues and writes recommendations to the relevant government institutions. [215] The Council’s 2017 report contained several suggestions about how the Danish government can do more to promote EV market penetration, including:

(1) There needs to be a long-term climate strategy for transportation with a focus on reducing CO2 emission. The following elements could help contribute:

(a) Denmark needs to establish a specific minimum number of zero-emission vehicles by 2030. An ambitious but realistic goal should be at least 500,000 – EVs should be in the majority;

(b) From the year 2030, the sale of personal vehicles fueled partly or wholly by petrol or diesel should come to a complete halt.

(2) The current tax on vehicles is not socioeconomically viable and the Climate Council recommends that further regulatory changes must be made to EV registration fees:

(a) Subsidies for large batteries should be made permanent, extending beyond the deadline of 2021;

(b) Abolish the minimum limit in the registration fee so that especially smaller EVs can get a greater benefit from their deductions related to battery size

(3) Better economic support for the sale of EVs and PHEVs. This proposes to replace the current subsidy scheme for registration fee with a quota obligation of EVs sold during the year.[216]

The Council’s report is extremely detailed and contains further suggestions on how the Danish government can shift its policies to better promote the sale and usability of EV nationally.

ii. Research in Electric Vehicles

The DEA provided funding for seventy-six EV projects in the Danish electrical grid system.[217] The projects research the following areas: the possibility of using EVs as a flexible storage unit, returning electricity to the Danish grid; barriers to the development and use of EVs; areas of advantage; and technical, organizational, and environmental conditions related to the use and maintenance of EVs.[218]

In the “test an electric vehicle” project, volunteers drove 198 EVs over 4 million kms, saving an estimated 16.1 tons of CO2 emissions for 1,578 participating Danish test families.[219] At the time, this project was one of Europe’s largest EV tests.[220] During the project, a vast amount of data was collected around security of use, EV charging pattern/optimization, and driving needs.[221]

The majority of these EV projects confirmed their hypotheses on the positives and negatives with EV integration and usage.[222] The studies showed that intelligent charging, which draws electricity at lower price-points and returns electricity to the grid, mitigates CO2 emissions and results in economic savings for every km driven.[223] Additionally, the studies demonstrated that knowledge of locations and functioning of public charging spots would incentivize EV owners to more frequently use them.[224] The report also displayed that out of 55,000 charges, sixty-nine percent happened at home, twenty-four percent outside of the home by use of alternating current (“AC”) structures, and eight percent by use of direct current (“DC”) structures.[225] The report found that there is a real opportunity to incentivize employers to install the proper infrastructure for charging EVs. In turn, charging infrastructure would be a deciding factor for a person to purchase an EV in the future.[226]

iii. EU-Wide Measures to Promote EVs Nationally

Implementing an EU-wide industry mandate to deliver a set minimum target of EVs could increase the number of electric vehicles in Denmark, and in other markets. Such a measure could also boost research and development in electric vehicle production and batteries. In return, this research could yield better vehicles with longer range, longer lifespan, and better consumer prices. The short-term market penetration for manufacturers would also have long-term learning effects to better predict market needs and help research and development to focus on developing the correct technologies. This type of policy could also set minimum standards in order to prevent low quality among EVs, thereby addressing several consumer concerns.

An inherent factor in creating a balance to the energy system’s fluctuation between supply and demand is efficient energy storage systems. Ideally, storage systems will have the ability to detect when there is excess electric energy entering the electrical grid. The electric storage resource will retain the excess energy and supply the grid when generation is scarce or demand is high. Currently, it is difficult to efficiently store energy at the required scale without significant loss. Denmark, as well as many other countries, require a close symbiosis between several technologies to fulfil the role of storage.[227]

There are many projects exploring the possibilities of energy storage in Denmark. The Danish government has agreed to use 130 million DKK (19.32 million USD) to develop large-scale storage systems.[228] These storage utilities would assist with optimizing the Danish grid to handle increased renewable energy generation.[229] The Danish Ministry of Foreign Affairs, which promotes foreign investments, has highlighted a few examples of projects that are currently being explored and tested.[230]

Amongst these storage projects is the Copenhagen Residential Area EnergyLab Nordhavn.[231] This project is exploring innovative energy storage solutions for urban areas and it has incorporated a full-scale smart city energy lab to its test area.[232] Since its commencement, the project has demonstrated how intelligent solutions can create a flexible and optimized energy system by integrating electricity, heating, energy-efficient buildings, and EVs. In terms of hard storage technologies, the company ABB has supplied battery technologies[233] for this project and supplies power to around 200 apartment units during peak demand hours.[234]

In Denmark’s Danish Society of Engineers’ (“IDA”) Climate Plan 2050[235], Danish CO2 emission are expected to be reduced by ninety percent compared with levels in the year 2000.[236] This climate plan assumes that the external transmission capacity remains the same.[237] The plan describes a scenario where transmission between the western and eastern Danish grid capacities are significantly enhanced by removing any bottlenecks.[238] Carrying out the IDA Climate Plan requires the transmission net to accommodate a large amount of renewable energy penetration.[239] Traditional electricity consumption will also have to decline to facilitate a more flexible electricity model. Creating more flexibility will allow for generated electricity to be consumed instantly, allowing fluctuation of renewable energy sources.[240] Similarly, the pricing structure will need to suit a model of flexibility, providing incentives to consume when electricity production is high.[241] According to the plan, the main elements that will take advantage of this model are electric heat pumps, EVs, and refrigerators.[242]

Sweden, like Denmark, used to be highly reliant upon oil imports to sustain its energy demand.[243] After the oil crisis in the 1970s, the government, in an attempt to make Sweden´s energy supply more secure and less dependent upon imports, introduced nuclear power into the country´s energy mix.[244] In addition to developing its nuclear capacity, Sweden has long been exploiting its renewable resources. Sweden’s most important resources are hydropower, onshore wind, and biomass.[245] While Sweden has among the highest levels of electricity use per capita in the world,[246] it has the second lowest CO2 emissions per capita.[247] This is partly due to the nearly decarbonized space heating and electricity generation made possible by relying on renewable resources and nuclear energy.[248] Overall, Sweden´s longstanding policies that focus on moving away from fossil fuels and towards renewable energy have been quite successful. However, challenges remain in phasing out nuclear power and increasing energy efficiency across all sectors.[249] This Article will start by explaining Sweden´s energy profile and consumption levels. Then, this Article will introduce some of Sweden´s challenges concerning its energy profile and discuss some of Sweden´s initiatives related to smart grid solutions.

Sweden, like most other European countries, still depends on imports to meet their domestic energy demand, especially in the transportation sector.[250] However, Sweden´s need for supply of fossil fuels has decreased significantly since the 1980s, due to the introduction of nuclear power and increased energy production from biofuels.[251] Sweden’s main sources of renewable energy include hydroelectric, wind, and biofuel.[252] Eurostat estimates Sweden´s overall dependence level to be thirty-two percent.[253]

Most of Sweden´s electricity production comes from non-fossil sources, primarily hydroelectric and nuclear power.[254] In addition to hydro and nuclear power, Sweden also produces electricity from wind,[255] CHP,[256] and solar.[257] While electricity production currently relies on hydro and nuclear power, production from wind and biofuel is steadily increasing.[258]

Sweden’s public utility and the responsible authority for the national grid, is Svenska Kraftnät.[259] The company operates the transmission lines, substations, and international 400 and 202 kilovolt (“kV”) interconnections.[260] Svenska Kraftnät is also the sole system operator for electricity—a TSO—in Sweden.[261] Three major companies—DSOs—own most of the regional grids: Vattenfall Eldistribution AB, Eon Energidistribution AB, and Ellevio AB. Together, these companies account for about 97.8% of all energy outtake.[262]

There are approximately 156 operators on the Swedish electric grid.[263] However, about half of Swedish customers purchase electricity from the three largest DSOs, who own about half of the local grids.[264] Every grid owner must attain a grid license from the Energy Market Inspectorate in order to build power lines.[265] The license obliges each operator to collect and report measurements on production and consumption, and to connect electricity plants in their area to the grid.[266] The cost of connecting to the grid is covered by the producer through network tariffs.[267] Swedish power plants are connected to the grid using a principle of non-discrimination. This means that renewable energy producers are not given priority, nor are they discriminated against.[268] Under certain conditions, a grid operator may reasonably deny a producer grid connection. This generally happens if the grid capacity is insufficient.[269]

Sweden´s energy usage is divided into three main sectors: (1) industry, (2) transportation, and (3) residential and service. According to Eurostat, 53.8% of Sweden´s gross final energy consumption[270] comes from renewable sources.[271] Still, Sweden´s energy consumption is currently higher than its 2020 goal.[272]

Sweden’s total energy use has decreased in the three main sectors over the last decade.[273] The transportation sector saw the largest decrease[274] which can be attributed to the introduction of more fuel-efficient vehicles.[275] These decreases have occurred despite growth in population.[276] The use of oil and other fossil fuels are declining, while the use of renewables are increasing.[277] In fact, biomass has become the third largest energy source in Sweden.[278] Despite the relatively constant energy consumption rate, and the slight decrease over the last decades, Sweden´s energy consumption per capita is still about fifty percent higher than the EU average.[279] Sweden has energy intensive industries, high transportation demands due to long distances between populated areas, and a relatively cold climate.[280] As such, it will be challenging for Sweden to reduce energy consumption to a more sustainable level.[281]

The main source of energy in the transport sector is oil and derived products like diesel, petrol, and aviation fuel.[282] However, the Swedish government has, as part of its long-term climate goals, set a target for the country´s vehicle-fleet to be fossil fuel independent by 2030.[283] While biofuels (mainly biogas, biodiesel, and ethanol) and electricity are growing sources of energy in this sector, [284] Sweden is still far from reaching its goal.[285] On the other hand, almost all Swedish fossil fuel consumption is attributed to the transport sector, and a shift away from this source would therefore have significant impact on the country´s overall energy profile.[286]

The industry sector accounts for approximately thirty-eight percent of the total energy use in Sweden,[287] and most of the energy used in that sector derives from biofuels and electricity.[288] Additionally, some energy comes from coal, oil products, natural gas, district heating, and other fuels.[289] Sweden’s industry sector energy consumption has remained relatively unchanged,[290] despite a moderate increase in production.[291] However, the increase in production has not led to an increase in energy use because industry actors have made structural changes and become more energy efficient.[292] Still, there is room for improvement in both energy efficiency and choice of energy carriers in the Swedish industry.

As early as 1991, Sweden was one of the first countries to introduce a carbon tax scheme, shifting industry´s tax burden from labor to carbon and energy consumed.[293] Several studies indicate that this reform has had an influence on reducing GHG emissions and affected the move towards the use of biomass in the district heating system.[294] Over the years, the government has introduced many different tax schemes in order to stimulate a reduction in energy usage, especially from fossil fuels.[295] These taxes include energy taxes, pollution taxes, resource taxes, and transportation taxes.[296] While these taxes impacted the decline in GHG emissions, accounting for some variation over time, a steady decline occurred before introducing these scheme.[297] Due to the international oil crisis in the 1970s, Sweden introduced nuclear energy in order to be less dependent upon oil imports.[298] This, combined with the simultaneous increase in renewables such as biomass, resulted in a decrease in oil use.[299]

The residential and service sector mainly uses energy from electricity and district heating, in addition to biomass and oil, accounting for around thirty-nine percent of the total energy use in Sweden.[300] Electricity from hydro and nuclear power is the main source of energy in the service sector, whereas heating and hot water accounts for about half of the energy used, including both residential and non-residential housing.[301] Additionally, a large portion of electricity goes towards household electricity and business electricity.[302]

Across Sweden, district heating is used extensively. By exploiting the excess heat created from CHP plants, the heat (and cold) supplied from these plants is distributed to industry and residential buildings through a network of pipes. This efficiently utilizes the CHP energy.[303] District heating is currently the main source of heating for dwellings and non-residential buildings, accounting for over half of the heating market. [304] District heating was initially fueled by fossil fuels.[305] However, over the last few decades the energy input has changed to include heat recycling and renewable fuels.[306] The largest amount of energy input today comes from biomass.[307] The second largest input source is waste incineration, in addition to a small amount from other sources, including fossil fuels like oil and coal.[308] In order to meet the national goal of no fossil fuels for heating by 2020, district heating distributers will have to move away from these energy input sources completely.[309] Studies estimate that by using new technology to implement better detection systems, thereby accounting for errors in the system and individual thermostats at an earlier stage, district heating will no longer need fossil fuels to meet peak demands.[310]

One of the most controversial issues in Swedish energy policy is nuclear power. Sweden has experienced both political and public pressure to phase out nuclear power and the government has initiated various policies to this end.[311] For example, a national referendum in 1980 proposed a decommission of all reactors by 2010, but was later changed to abandon the target date of 2010. Additionally, a proposal in 1997 aimed to shut down two reactors but so far has only resulted in the decommissioning of one.[312] Unsurprisingly, nuclear power is a contentious area in Swedish politics because Sweden is heavily reliant on nuclear power for electricity production.[313] Studies also show that replacing nuclear power in Sweden is likely to increase GHG emissions and negatively impact electricity prices as energy import would have to increase.[314]

Currently, the government will not enforce the phase-out of nuclear power. Indeed, Sweden permits the construction of new reactors, but only on existing sites.[315] Still, as the Framework Agreement stipulates, Sweden has a target of 100 percent renewable electricity production by 2040. As such, it seems unlikely that investors will find building new nuclear reactors attractive.[316] In fact, due to policy decisions, low electricity prices, and the age of existing reactors, it is expected that more reactors will shut down earlier than intended. As of now, there are eight active reactors in Sweden, four of which the government will decommission by 2020.[317]

Meeting the demand for electricity will become more challenging with the phase out of nuclear power and the increased use of renewables.[318] While increased use of electricity from hydro and wind power replaces fossil fuels, especially in the industry and transportation sector, it is also adds pressure to Sweden´s grid to meet the heightened demand from fewer input sources.[319] The electricity grid in Sweden is one of the world’s oldest national grids, and many of the installations are in their operational end cycle.[320] Due to the inclusion of more intermittent energy, the country needs to upgrade the grid to secure its reliability in the future. Svenska Kraftnät is currently working on both assessing the grid and expanding new lines to meet these needs, as well as preparing for a common European electricity market.[321] In addition to upgrading the physical grid, these changes will require increased flexibility in planned production, and the possibility for energy storage and demand/response flexibility, to ensure a reliable power system.[322]

There are challenges associated with Sweden’s move away from nuclear power to intermittent renewable energy.[323] Meeting these challenges and more, Sweden is attempting to make the energy system “smarter” by implementing different smart grid solutions.[324] A variety of research and development and pilot projects are currently working to determine the most cost-effective, durable, and efficient ways to implement smart grid solutions.[325] In 2012, the government established the Swedish Coordination Council for Smart Grid,[326] which was tasked with establishing a national platform for knowledge sharing and drafting an action plan for the expansion of smart grid solutions in Sweden.[327] The council published its action plan “Planera för Effekt!” (Planning for Effect) in 2014.[328] The plan is based on three main pillars: (1) political framework and market terms and conditions; (2) customer participation and societal aspects; and (3) research and development, innovation, and growth.[329] After receiving the action plan, the government established the Swedish Smart Grid Forum as a permanent successor to the council.[330]

SweGRIDS is another research and development organization, established as a partnership between academia, industry, and public utilities, largely funded by the Swedish Energy Agency (“SEA”).[331] The organization is running many different research projects related to smart grids, including the development of electric power grids and management of renewable energy input.[332] The research projects will run until 2021.[333]

Sweden started another pilot project between 2012 and 2017 as a cooperative project involving the SEA, the Swedish Smart Grid Forum, relevant industry actors, and private individuals.[334] The aim of the project was to implement smart grid solutions at Gotland, a small island in Sweden, to test how different solutions would affect the electricity grid, the customer’s experience, and consumption.[335] By installing smart meters, the grid operators received near real time updates on the grid status, and the costumers are able to shift their usage to take advantage of peak production hours[336] as opposed to peak load hours.[337] The project also tested the functionality of existing grids with higher amounts of wind power and it demonstrated that new smart technology can improve the electricity quality in rural grids with high levels of distributed power production at a low societal and economic cost.[338]

Another Swedish pilot project, aimed at building the world’s smartest electricity grid, is the Stockholm Royal Seaport.[339] The project involves the SEA, together with research institutes and various industry actors, in cooperation with C40 (the Cities Climate Positive Development Program).[340] The groups started the project in 2009 and they estimate that the construction of homes, workplaces, and infrastructure will be completed in 2030.[341] One of the project’s main objectives is to drastically reduce GHG emissions and develop a climate positive urban district.[342] The main difference between the two large-scale research and development projects at Gotland and Stockholm Royal Seaport is that the Gotland project is testing smart grid solutions in a rural setting, while the Stockholm Royal Seaport is an urban project.[343]

These examples are just a few of the many research and development projects conducted in Sweden. However, most smart grid solutions are in development and not yet fully in effect.

Sweden reduced GHG emissions by 22.5 percent from 1990 to 2016, meeting its national targets.[344] However, due to an increase in primary energy consumption during 2016, the country fell short of meeting its 2020 targets. [345] In the transport sector, the aim is to achieve at least ten percent renewable energy consumption by 2020.[346] To further Sweden´s commitment towards a more sustainable energy profile, the government tasked the Parliamentary Commission’s Cross-Party Committee on Environmental Objectives with determining a comprehensive long-term climate strategy.[347] The goal was to establish a broad cross-party agreement regarding the country’s energy policies that would not be easy to change.[348] This would help in the election of successive governments by achieving a more controlled and continuous transition into a completely renewable electricity system. The Framework Agreement presented by the committee[349] was adopted by the Parliament (Riksdagen) in 2017.[350] The climate policy framework of Sweden now consists of three pillars: (1) the Climate Act,[351] (2) the climate goals,[352] and (3) a Climate Policy Council.[353]

First, the Climate Act of January 2018 is the over-arching legislation in Sweden related to climate.[354] The Act requires the government to implement policies based on the climate goals.[355] Additionally, the Act requires the Swedish government to present an annual climate report together with the state’s budget bill and to draw up a climate policy action plan every four years.[356] The aim of the Climate Act is to insure that each consecutive government pursues a coherent climate policy, based on the goals set out in the Framework Agreement.[357]

Second, as mentioned above, Sweden established the goal of 100 percent renewable electricity production by 2040.[358] However, this goal does not automatically prohibit nuclear electricity production after 2040.[359] In the domestic transportation sector, Sweden is attempting to become fifty percent more energy efficient and reduce GHG emissions by at least seventy percent by 2030.[360] Sweden is also attempting to have net-zero GHG emissions by 2045, and thereafter achieve negative emissions.[361] In the short term, Sweden aims to have emissions at least sixty-three lower by 2030 and seventy-five percent lower by 2040.[362] This will be achieved by increasing the forests’ CO₂ uptake and by investing in various climate projects abroad, in addition to actual GHG reduction.[363] Still, such measures may only account for a maximum of eight percent of the 2030 and two percent of the 2040 emission targets respectively.[364]

Third, a climate policy framework of any country is susceptible to change after an election where a new government takes the reins.[365] Thus, the role of the Climate Policy Council is to independently assess whether or not each government’s policy framework is consistent with the climate goals.[366] The three-part Swedish policy framework fosters legally required coherence and consistency in policy initiatives across party lines, regardless of the specific party formation in government and Parliament. Still, the Climate Act does not contain any possibilities for placing sanctions on a government that is not fulfilling its duty towards the climate goals.[367] As stated in the Swedish constitution, it is each government’s privilege to govern in the way it sees fit.[368] As such, any government may amend or abolish the Climate Act, if a majority in the parliament so chooses.[369] The Climate Act sets out the overarching climate goals but does not specify how the government must proceed with its policy making.[370]